$PESKY Tokenomics, Part 1

There's more to minting a fungible token than slinging code and pressing "GO."

In this post, we'll talk about the regulations around creating digital assets, and why careful planning is necessary to ensure both a healthy economy and a successful future for the project.

Part two will conclude with our vision for what a $PESKY token might look like in terms of utility and tokenomics.

SEC Compliance

The way digital assets are issued and marketed influences whether or not they require regulation (in the USA) by the SEC.

There's plenty of official

documentation

on the subject, but the tl;dr is that tokens and securities that pass the "Howey Test" need to register with the SEC.

The Howey Test

The Howey Test is a framework for analyzing whether a digital asset is an investment contract, and whether offers and sales are securities transactions. If the digital asset passes the Howey Test, it needs to be registered with (and regulated by) the SEC.

There are 3 elements of the Howey Test:

-

The Investment of Money: Was the digital asset acquired in exchange for money? This can be another digital currency or anything thing of value, not just fiat.

-

Common Enterprise: Is the fortune of individual investors tied to the fortunes of the other investors by the pooling of assets (with the pro-rata distribution of profits)? What's the relationship between the promoter and the body of investors?

-

Reasonable Expectation of Profits Derived from Efforts of Others: Does the purchaser have a reasonable expectation of profits (or other financial returns) derived from the efforts of others? Can a purchaser expect to realize a return through participating in distributions or through other methods of realizing appreciation on the asset, such as selling at a gain in a secondary market?

Basically, any token issued in exchange for money, where participants can expect to make money, should be registered with the SEC.

The Supreme Court has further explained that that the term security "embodies a flexible rather than a static principle" in order to meet the "variable schemes devised by those who seek the use of the money of others on the promise of profits."

The above quote, from one of the docs linked above, states that, in addition to a lack of comprehensive guidance for digital assets from the SEC, the Supreme Court's stance is, "if you're trying to make money from people by implying value will increase over time, you're a security."

What does that mean for a $PESKY token?

The Pesky Penguins team operates out of the United States of America, and we have every intention of complying with all rules and regulations to which we are subject, especially those that exist to protect our community members.

To that end, we have contracted with CPAs and subject matter experts to provide counsel what we can and cannot do regarding tokens, as well as help figure things out like, "do we pay taxes on Snowball royalties?" (Answer: "only if there's a profit at the end of the reporting period.")

Keeping the Howey Test in mind, and with the understanding that we do not yet have final sign-off from our CPAs and advisory team, we have the following broad ideas when it comes to creating a $PESKY token:

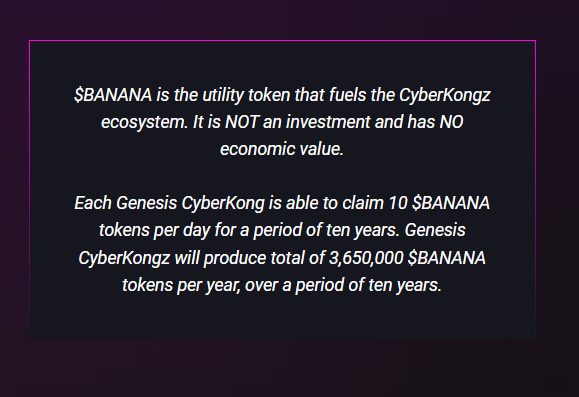

- We intend for the token to be a UTILITY token with no monetary value.

- We DO NOT intend to issue the token through an initial sale, as this would assign value to the token

- We intend to communicate, clearly and regularly, about how the

$PESKYtoken has no monetary value. (See what we did there?)

We DO think that a $PESKY token can add utility to the collection, and this utility will be in service to our community.

We're exploring ways to enhance and customize your Pesky Penguins experience in ways that will NOT affect the overall value of the collection.

A good example of a utility token is the $BANANA token from the CyberKongz project:

We'll explore more ideas for how $PESKY tokens could be used in our next post!

What about all those other Tokens?

We are members of a global community, united by an internet that spans the entire globe. Many token creators and their investors may very well be operating within the established guidelines of their local jurisdictions!

The teams issuing for-profit tokens based in the US should be registered with and regulated by the SEC, which exists to protect investors from bad actors.

There's no way of knowing when the SEC is going to begin cracking down, but as the commission becomes more savvy, and as the overall market cap of digital assets continues to grow, it is reasonable to assume that many existing tokens could be forced to register with the SEC and/or be fined into oblivion for failing to do so earlier.

We are not trying to FUD other tokens, nor are we offering financial advice (do your own research!), just explaining our reasoning behind why the $PESKY token will be a utility token.

What's next?

Our goal is to help make being a member of Pesky Penguins one of the best experiences on web3. It's thanks to all of you that our community is so fun and welcoming, and we want to empower you to have as much fun nooting as possible!

We're still working with our advisory team to get final sign-off before pressing ahead with tokens, but planning is already underway! We'll share more about our vision for the $PESKY token in part two.

Thanks for tuning in and for being a member of the community 🥰